16+ Mortgage payable

Each of the monthly payments includes a 3000 principal payment plus an interest payment of approximately 1500. EBS New Business Variable Rates.

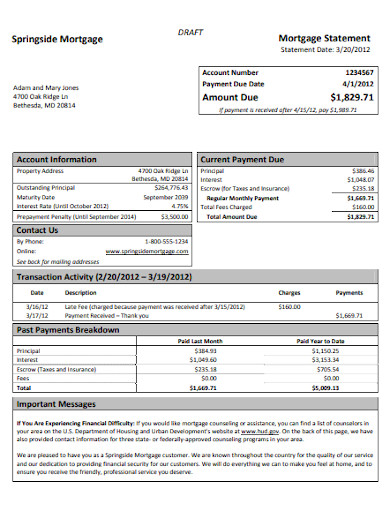

Mortgage Statement 10 Examples Format Pdf Examples

Is there an example of how a reverse mortgage works.

. Scenario 1 First-time buyer 1 year in 29. Includes illustrations and loan comparisons. Your home value has increased considerably.

1 Act as a mortgage broker means to act for compensation or gain or in the expectation of compensation or gain either directly or indirectly by. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. In order to create a Totten trust the account owner completes.

The mortgage should be fully paid off by the end of the full mortgage term. And Mortgagees Optional Extension to Submitting a Due and Payable Request. The accounting entry is.

If so then the mortgage is payable in full upon demand of the mortgage company. You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. Over the 16 years from 2002 to 2018 the house price to earnings ratio has risen from 5 to 78.

You need to check with the mortgage company and review the contract that was signed when the loan was taken. A revocable bank account trust. July 9 2022 Child Custody Considerations in Military Divorces Read More.

See how much you can expect from a reverse mortgage loan by these 3 popular examples. 2016-16 Home Equity Conversion Mortgage Program. 2016-19 2017 Nationwide Home Equity Conversion Mortgage HECM Limits.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Mortgage balance Total payable after holiday Monthly repayments after holiday. With a capital and interest option you pay off the loan as well as the interest on it.

Example of Recording an Asset that was Partially Financed Assume that your company purchased a car for 10000 by paying cash of 4000 and signing a promissory note for 6000. Payable on death accounts may also be known as. Another type of financial mechanism which is known as a Totten trust may be considered as a type of payable on death account.

When to consider a refinance of your reverse mortgage. I soliciting processing placing or negotiating a mortgage loan for a borrower from a mortgage lender or depository institution or offering to process. 2016-05 Additional Guidance related to Mortgagee Letter 2015-15 Mortgagee Optional Election MOE.

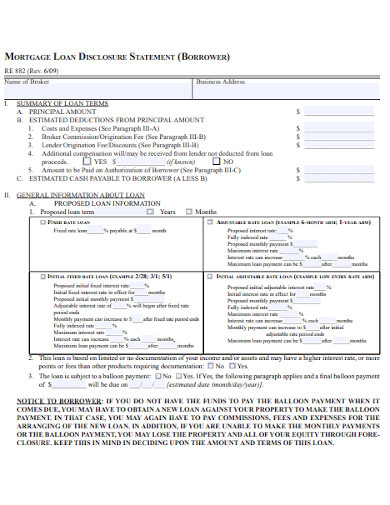

2022 By Michael Branson 16 comments. Debit the asset account Automobiles for the cost of 10000 Credit the asset account Cash for. Example of a Mortgage Loan Payable.

Lets assume that a company has a mortgage loan payable of 238000 and is required to make monthly payments of approximately 4500 per month. At the end of the mortgage term the original loan will still need to be paid back. Most low-down mortgages require a down payment of between 3 - 5 of the property value.

For information on the EBS Variable Rate Policy Statement please click here. Source for 10-Year LIBOR Swap Rate. Also if you have no mortgage now the reverse.

Mortgage programs which require a minimal down payment. Owner Occupier mortgage customers may be able to move to a lower Loan to Value LTV interest rate where the LTV changes sufficiently throughout the mortgage. The following definitions apply in this chapter.

However some lenders have. July 16 2022 Cheryl Burke Matthew Lawrences Divorce Read More. A variable rate can go up and down.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. This means that there has been more than a 50 rise in the cost of a house relative to our earnings. Have a look at EBS new home loan variable rates below.

Or the reverse mortgage lender would call the note due and payable. Lenders mortgage insurance LMI also known as private mortgage insurance PMI in the US is insurance payable to a lender or trustee for a pool of securities that may be required when taking out a mortgage loanIt is insurance to offset losses in the case where a mortgagor is not able to repay the loan and the lender is not able to recover its costs after foreclosure and sale of the. With an interest only mortgage you are not actually paying off any of the loan.

In trust for or ITF accounts.

Ways To Pay Off Your Mortgage Early And Why We Did It

16 Free Weekly Budget Templates Ms Office Documents Weekly Budget Template Budgeting Budget Template

Free 16 Mortgage Agreement Contract Samples Templates In Pdf Ms Word

Ways To Pay Off Your Mortgage Early And Why We Did It

Mortgage Statement 10 Examples Format Pdf Examples

12 Practical Satisfaction Of Mortgage Forms Word Pdf Find Word Templates

16 Free Weekly Budget Templates Ms Office Documents Weekly Budget Template Budget Template Budgeting

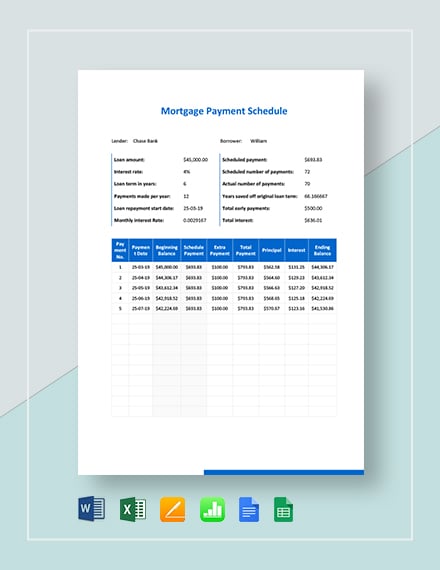

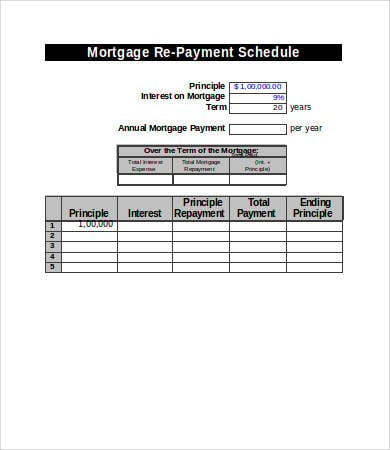

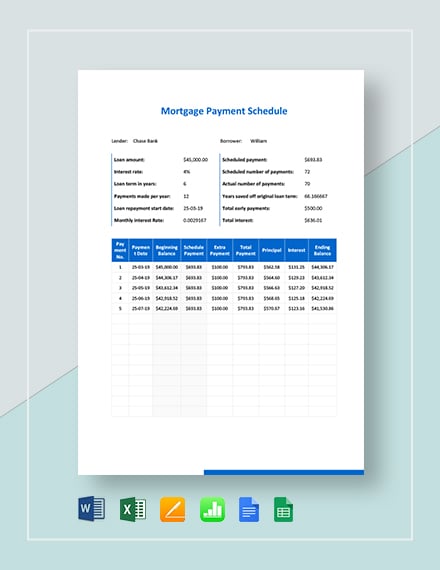

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

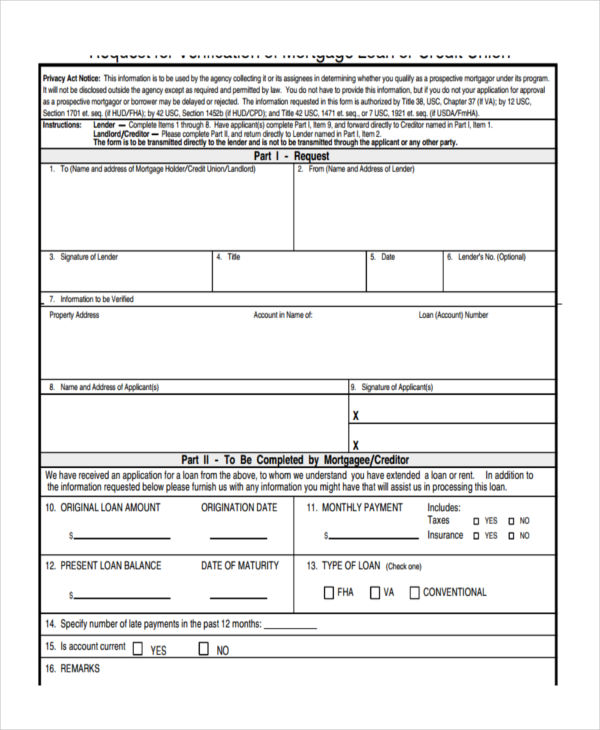

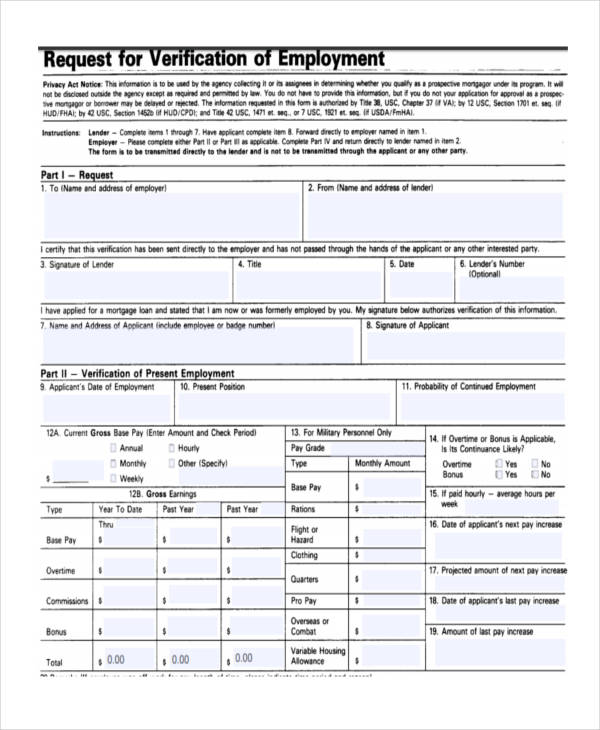

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

Free 8 Sample Mortgage Verification Forms In Pdf Ms Word

12 Practical Satisfaction Of Mortgage Forms Word Pdf Find Word Templates

Mortgage Statement 10 Examples Format Pdf Examples

Ways To Pay Off Your Mortgage Early And Why We Did It

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

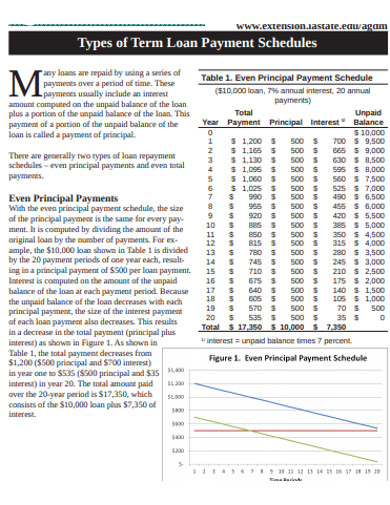

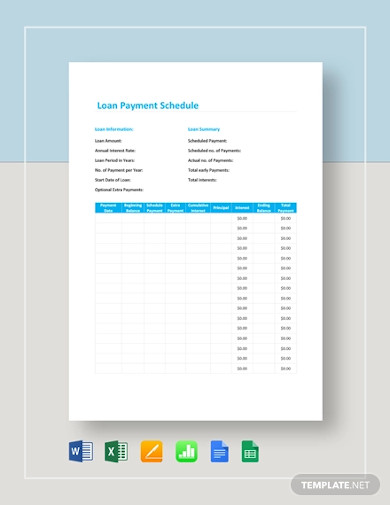

Loan Schedule 15 Examples Format Pdf Examples

16 Loan Schedule Templates In Google Docs Google Sheets Xls Word Numbers Pages Free Premium Templates

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates